Markov Seminars

Spread Trading with the Multivariate Ornstein-Uhlenbeck Model

In The Multivariate Ornstein-Uhlenbeck Model as an Alternative to Regressions, we considered the relative valuation of the CADUSD...

The Multivariate Ornstein-Uhlenbeck Model as an Alternative to Regressions

One of the statistical approaches most frequently used by financial analysts is regression analysis, as it allows comparisons of current...

Horizon-Dependent Directionality in a BTP Butterfly Spread

I recently analyzed a butterfly spread involving the yields of three Italian government bonds: BTP 4.5% Mar-24 BTP 1.85% May-24 BTP 3.75%...

Time-Varying Means to Capture Seasonality in the Multivariate Ornstein-Uhlenbeck Process

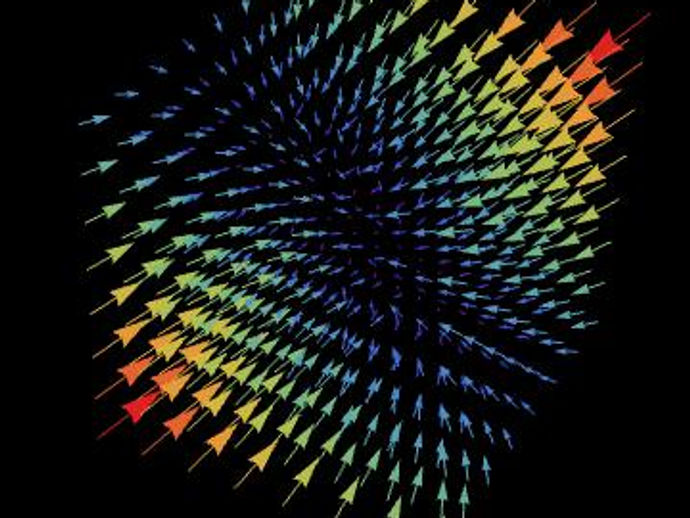

In ‘Cyclical Vector Fields and Seasonality,’ we saw that a rotational vector field could introduce seasonal patterns to prices over time,...

Seasonality and Stationary with the 'Drain' Vector Field

In my last post, I noted that we could specify the vector field of a multivariate Ornstein-Uhlenbeck process to be cyclical so as to...

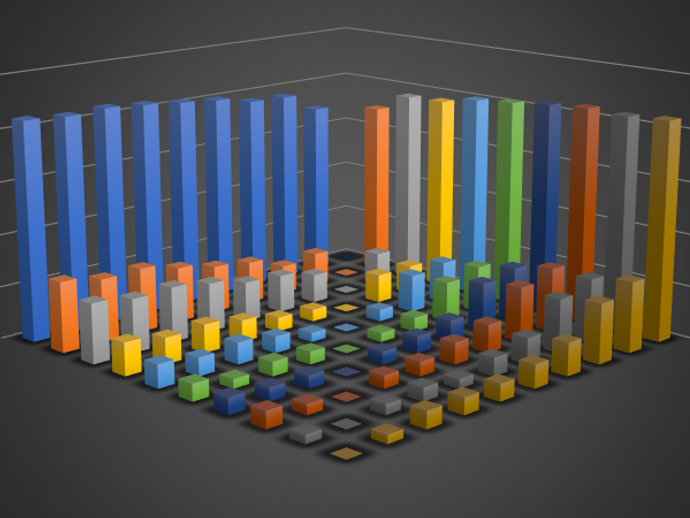

Cyclical Vector Fields and Seasonality

A diffusion process can be viewed as a scaled Brownian motion dropped into a vector field. And the set of vector fields that can be...

Be Careful When Modeling Spreads As Univariate Processes

In my previous notes on the multivariate Ornstein-Uhlenbeck process, I focused on the fact that correlations in this framework generally...

Interactions Between 5Y and 10Y Treasury Yields

In my last post, I noted that the empirical correlation of the change in 5Y and 10Y Treasury yields since 1962 depends on the frequency...

What's Been the Correlation of 5Y and 10Y Treasury Yields? It Depends on the Observation Frequency.

In my last note, I discussed the way the interaction between two variables that follow a bivariate Ornstein-Uhlenbeck process can cause...

When Correlations Depend on Frequency of Observation

Years ago, shortly after I joined Deutsche Bank, my boss asked me to calculate some correlations for a note he was writing. When I placed...